Are you thinking of how to get financing for a high rise? Obtaining financing for a high rise is not like obtaining finances for a single-family home. High rise residences come at a price, and unless you have a huge amount already in place, you’ll have to avail some sort of financing. Find out how to get a condo mortgage here.

Mortgage Options

High rise residences are very popular these days. People love the idea of a “less maintenance and more amenities” lifestyle.

More and more people are opting to live in condos, especially high rise developments.

If you want to buy a high rise condo, you’d probably need a condo financing.

When you buy a single-family home, getting a mortgage loan is fairly easy. But it’s not the same when you try to secure financing for a condo.

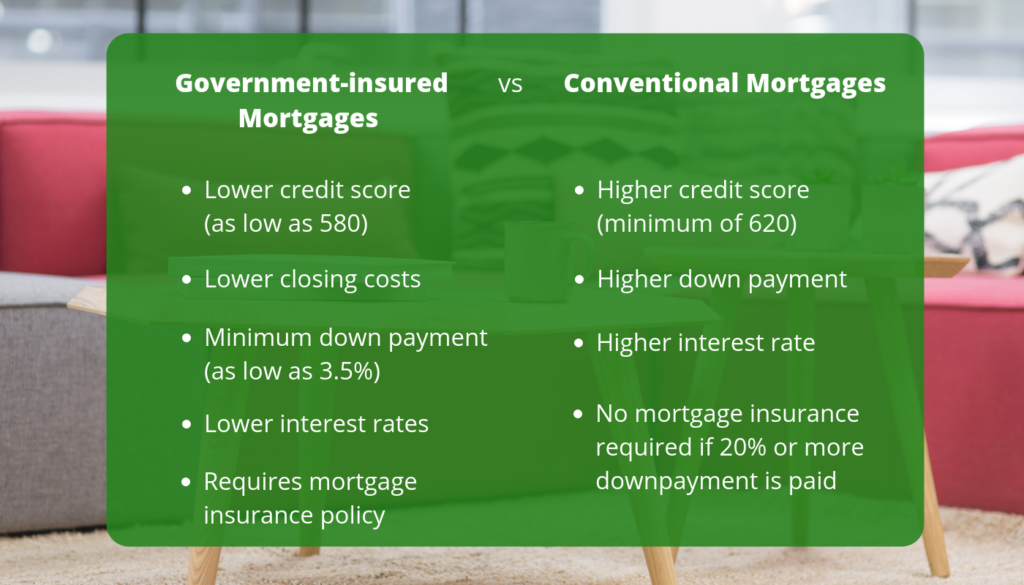

In the U.S, there are two prevalent kinds of home mortgages and these are government-insured and conventional.

- Government-insured mortgages include FHA Loans and VA Loans, and USDA Loans.

- Conventional mortgages are loans not insured by the federal government.

Here’s a simple comparison between government-insured mortgages and conventional mortgages.

Government-insured loans are more popular and definitely preferable. Since these kinds of financing are backed by the federal government, many lenders support them and provide a wide range of options to homebuyers.

When it comes to financing for a high rise, things are different. There are more restrictions and limitations, which makes financing difficult.

How to Qualify for an FHA-Insured Loan

If you are interested in buying a high rise, the first step you need to do is to make sure you are FHA qualified.

As shown on the table above, FHA has less strict standard requirement when it comes to home loans, but they still have some standards that must be met. You need to pass most, if not all, of the qualifications to be eligible for an FHA loan.

Check out some of the FHA requirements below:

- A FICO score of 580 and higher if you’ll put down at least 3.5% deposit

- A FICO score of 500 – 579 for 10% down payment

- Must show recent tax returns, W2’s, and paycheck stubs

- Intend to use the property as the primary residence

The second thing you have to do is to make sure that the property you are eyeing is approved by the FHA.

If the condominium is FHA approved, the next step is to meet with your agent, find the unit that suits you, and start the loan application.

Soon you’ll be heading to the closing table and receiving a key to your property.

Condo Requirements to Be FHA Approved

Due to the Federal Housing Association’s strict guidelines, there’s only a small number of condominium projects that are approved. This year, the FHA once again released its list of condos and townhomes eligible for FHA loans.

Due to the Federal Housing Association’s strict guidelines, there’s only a small number of condominium projects that are approved. This year, the FHA once again released its list of condos and townhomes eligible for FHA loans.

In Las Vegas, there are two FHA approved condos and these are One Las Vegas and The Ogden.

That means you can take out an FHA loan and purchase a unit in either the One Las Vegas or The Ogden, because they are FHA approved condos.

FHA approved condos are properties that can be purchased using FHA loan. These properties met the guidelines and requirements set by the U.S. Department of Housing and Urban Development

What are the requirements for a condominium to be FHA approved?

There’s a full list of HOA requirements to be checked before a condominium will be approved.

Here are some of them:

- Construction on the property must be fully completed. The project must have completed for a year, with no additions or pending works.

- No more than 50% of the property can be used as a commercial space.

- No more than 15% of units can have delinquent dues longer than 60 days.

- No more than 50% of the units can be investor-owned / rentals

- For Reserve Funding – At least 10% of all budgeted income must go toward a reserve account.

- The funds must cover all insurance deductibles.

- The reserve funds must cover capital repairs and replacements for the next two years

- The property must be completely insured.

How to Qualify for a Conventional Loan

What if the building you like is not FHA loan eligible?

Can you buy a condo with a conventional loan?

The answer is “Yes, you can!”

Conventional loans actually make up most of the shares in high rise residential areas.

When you go to the bank to apply for a loan, the bank evaluates the loan based on two important criteria ― your creditworthiness and the property you intend to buy.

The bank or the lender will want to ensure that you can repay your loan and that if you default on your payment, that it can sell the property and recoup its money.

Unlike applying for an FHA-insured loan, the process of conventional financing for a high rise is pretty straightforward.

The following are the requirements for a conventional loan:

- A credit score of at least 680. The higher the score, the lower the loan interest rate.

- A debt-to-income ratio not more than 43%

- 20% down payment (This part is negotiable. Lenders prefer you put down at least 20% of the purchase price)

- Mortgage insurance if you can’t give the 20% down payment, and pay its monthly premiums until you reach at least 20% equity of the property

- Proof of income You should provide proof of steady income source, tax returns for two years, quarterly statement of your assets, 2 years of W-2.

- Employment verification

- Other documentation

Condo Requirements for Conventional Loans

Aside from your creditworthiness, the lender will also assess the property.

The following are some of the things they will check:

- HOA Finances. The bank checks the homeowner’s association finances along with the status of the other units in the building. It will also check how many units are foreclosed.

- Condo documents. The lender will check for any red flag in the condo documents that shows possible situations which may lead the property to depreciate.

- Percentage of owner-occupied units. The lender will also consider how many units are owned and how many are rented.

All these factors play a role in the bank’s decision.

If you and your high rise building meet all these requirements, your condo mortgage will proceed like a regular home loan. Soon, you’ll be the proud owner of a high rise Las Vegas condo unit.

Lenders, banks especially, believe that a condo development with more homeowners is less risky than one with a lot of rentals. This is because they think that homeowners are more likely to take good care of the property and take a better interest in maintaining the common areas than someone who is renting the condo unit.

All these factors play a role in the bank’s decision.

If you and your high rise building meet all these requirements, your condo mortgage will proceed like a regular home loan. Soon, you’ll be the proud owner of a high rise condo unit.

If you’re a first-time buyer, you would want to look at FHA loans. These types of loans have more relaxed credit score requirements and only require a minimum down payment.

When you have more time to save, it’s best to save so you can pay 20% down payment. Saving more gives you a better chance of getting that mortgage, builds you home equity right away, and puts you in a better position to negotiate for the home price.

A large down payment also reduces your monthly payments and saves you from buying private mortgage insurance.

Getting financing for a high rise may be challenging, but when you can enjoy exceptional views and luxury, it is worth all the effort.